does florida have state capital gains tax

What taxes do you pay when you sell a house in Florida. Section 22013 Florida Statutes.

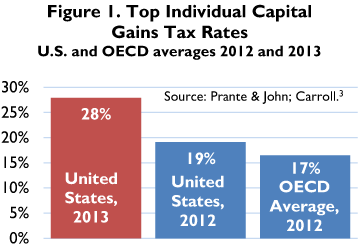

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

The state of FL has no income tax at all -- ordinary or capital gains.

. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the. Ncome up to 40400. It doesnt apply to S-corporations LLCs partnerships or sole.

The State of Florida does not have an income. For example a married couple filing jointly can earn up to 83350 and not owe federal taxes on a realized capital gain. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet.

The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations. Special Real Estate Exemptions for Capital Gains. Federal long-term capital gain rates depend on your.

Be sure to understand whether your state taxes capital gains and to what extent before filing your tax return. Tips for Navigating Tax Planning. Florida does not have state or local capital gains taxes.

There is no Florida capital gains tax on individuals at the state level and no state income tax. The rate is 15 for a couple with a taxable income of. The State of Florida does not have an income tax for.

What Is The Capital Gains Tax Rate In Florida. Its called the 2 out of 5 year rule. The state of florida does not have a state income tax and it also does not have a capital gains tax regardless of your state of residency.

What You Need To Know 2022. Capital gains taxes can be tricky when investing especially when you have to figure out both federal and state taxes. TOP 5 Tips 1 day ago Jun 30 2022 Florida does not have state or local capital gains taxes.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. Individuals and families must pay the following capital gains taxes. Make sure you account for the way this.

Heres an example of how much capital gains tax you might. The state taxes capital gains as income. The Combined Rate accounts for the Federal capital.

Residents living in the state of Florida though there are those. The rate reaches 65. Generally speaking capital gains taxes are around 15 percent for US.

Florida does have an income tax on corporations. The state taxes capital gains as income. If you are a resident of FL and you have gains on the sale of a capital asset you would not owe any taxes.

The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. The tax rate only applies to C-corporations. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022.

The Combined Rate accounts for the Federal capital. The rate is 55. What Is The Capital Gains Tax Rate In Florida.

5 days ago Jun 30 2022 Florida does not have state or local capital gains taxes. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly.

2022 Capital Gains Tax Rates Federal And State The Motley Fool

12 Ways To Beat Capital Gains Tax In The Age Of Trump

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

Capital Gains Tax Rates By State Nas Investment Solutions

Foreign Capital Gains When Selling Us And Foreign Property

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Short Term And Long Term Capital Gains Tax Rates By Income

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Capital Gains Tax In Kentucky What You Need To Know

Guide To The Florida Capital Gains Tax Smartasset

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

State Taxes On Capital Gains Center On Budget And Policy Priorities

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

Real Estate Capital Gains Tax Rates In 2021 2022

Florida Tax Rates Rankings Florida State Taxes Tax Foundation